As we usher in 2024, the global economic terrain is ripe with prospects for discerning investors. Amidst a backdrop of recovery from previous upheavals, this year promises a spectrum of growth opportunities, albeit at diverse rates worldwide. The surge in digital innovation, a pivot towards sustainability, and the evolving post-pandemic landscape are poised to be the linchpins of economic progress.

Tech Innovations: The Investment Frontier

The relentless march of technology continues unabated, with AI, blockchain, and quantum computing leading the charge. These breakthroughs are not just revolutionizing existing sectors; they’re unveiling new horizons for investment, setting the stage for a transformative year.

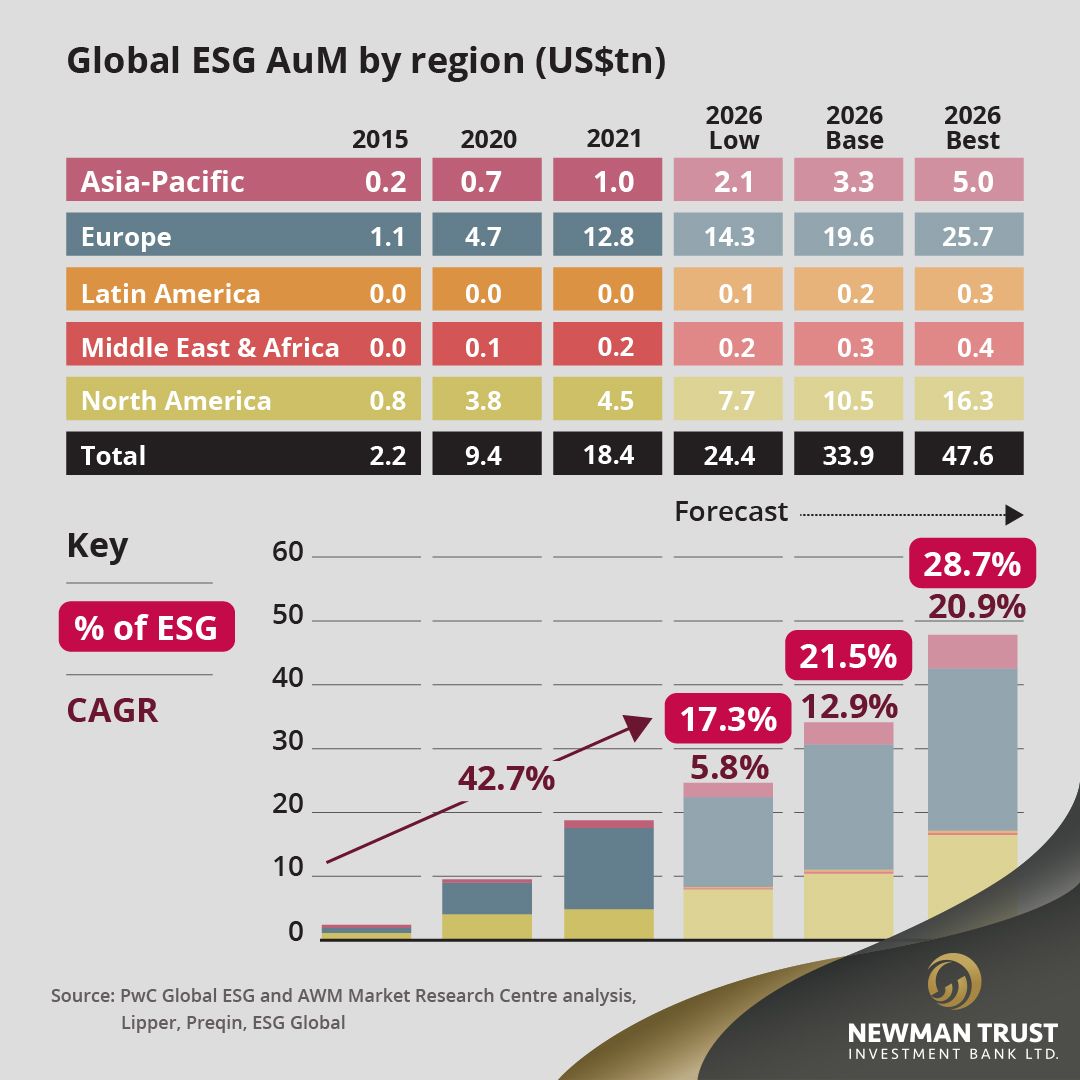

Sustainability Takes Center Stage

The spotlight on ESG Investing intensifies in 2024, as the clamor for responsible investment solutions gains momentum. This shift towards green tech, renewable energy, and sustainable industrial practices underscores a broader market evolution, mirroring investors’ values and future-forward aspirations.

Geopolitical Dynamics: A Calculated Navigation

With the global stage marked by shifting alliances and tensions, understanding the interplay of trade policies and international relations becomes critical. These factors, influencing supply chains and investment currents, underscore the need for investor vigilance and adaptability.

Embracing Volatility with Diversification

Amidst ongoing market fluctuations, the wisdom of diversification cannot be overstated. By spreading investments across various assets, regions, and sectors, investors can shield their portfolios from turbulence, readying themselves for the unpredictable waves of 2024.

The Digital Asset Revolution

The intrigue surrounding digital currencies and NFTs continues to captivate the financial world. With regulatory frameworks evolving and mainstream acceptance growing, these digital frontiers offer speculative yet potentially rewarding ventures.

Demographics and Consumption: The Changing Tide

The impact of demographic shifts on the market is profound, with aging populations and the economic ascent of younger cohorts reshaping consumer landscapes. Businesses and investors alike must pivot to these new patterns to capture the evolving essence of demand.

The Lure of Emerging Markets

The allure of Asia’s emerging market opportunities is stronger than ever, propelled by burgeoning consumer bases, tech uptake, and infrastructural strides. These regions stand out as beacons of growth, inviting investors to partake in their upward journey.

As we navigate the complexities of the year ahead, these insights provide a compass for strategic investment planning. Yet, the essence of success lies in informed decision-making and agility, adapting to the ever-changing investment climate of 2024.

For those seeking to stay ahead of the curve, adapting to these trends and aligning investments with the emerging economic patterns will be key to unlocking new opportunities and achieving investment success in the dynamic year of 2024.

***Disclaimer: This article is provided for informational purposes only and is not intended as financial, investment, legal, or other professional advice. Before making any investment decisions, it is recommended that you seek advice from financial, investment, and legal professionals to consider your individual financial circumstances and risk tolerance. Neither the author(s) nor the publisher(s) shall be liable for any loss or damage whatsoever arising from or in connection with the content of this article, including but not limited to direct, indirect, incidental, punitive, and consequential damages. Investing in the stock market and other financial markets involves risks, including the loss of principal. Please conduct your due diligence and consult with a qualified professional before making any investment decisions.