As Southeast Asia continues to develop economically, capital markets in the region are evolving rapidly. One of the most significant shifts has been the rise of green infrastructure projects, driven by governments’ commitment to sustainability and growing investor demand for environmentally conscious investments. These trends present lucrative opportunities for investors looking to align financial returns with environmental and social goals.

The key capital market trends in Southeast Asia, emphasizing green infrastructure development and how investors can capitalize on these emerging opportunities. By implementing sustainable investment strategies, investors can support regional growth while achieving strong financial returns.

Capital Market Trends in Southeast Asia: The Green Shift

Southeast Asia, home to some of the world’s fastest-growing economies, has witnessed increasing focus on environmental sustainability. Governments across the region are setting ambitious targets to reduce carbon emissions and invest in infrastructure that supports sustainable growth. This green shift is reshaping the capital markets, attracting both domestic and foreign investors.

1. Capital Market Trends in Southeast Asia: The Green Shift

Green bonds have become a critical tool for financing eco-friendly projects. According to the Climate Bonds Initiative, Southeast Asia’s green bond market reached a record $27 billion in 2023, with Indonesia, Singapore, and Malaysia leading the way. These bonds finance projects such as renewable energy, sustainable transport, and energy-efficient buildings.

2. Green Infrastructure Projects as a Catalyst for Growth

Southeast Asia’s infrastructure needs are immense, with an estimated $2.8 trillion investment requirement by 2030, according to the Asian Development Bank. Green infrastructure projects, such as renewable energy generation, electric transportation networks, and water resource management, are critical to addressing both the region’s economic and environmental challenges. (Source)

For private equity firms and institutional investors, green infrastructure presents a dual opportunity. On the one hand, these projects promise significant returns through government-backed contracts and long-term concessions. On the other, they offer a way to align investment strategies with Environmental, Social, and Governance (ESG) principles. In markets like Malaysia and the Philippines, public-private partnerships (PPP) are becoming more common, providing a secure investment avenue for long-term infrastructure development.

Capital Market Trends in Southeast Asia: The Green Shift

As green infrastructure becomes a cornerstone of Southeast Asia’s economic future, investors need to adopt strategies that maximize both financial returns and sustainable outcomes. Here are key approaches to consider :

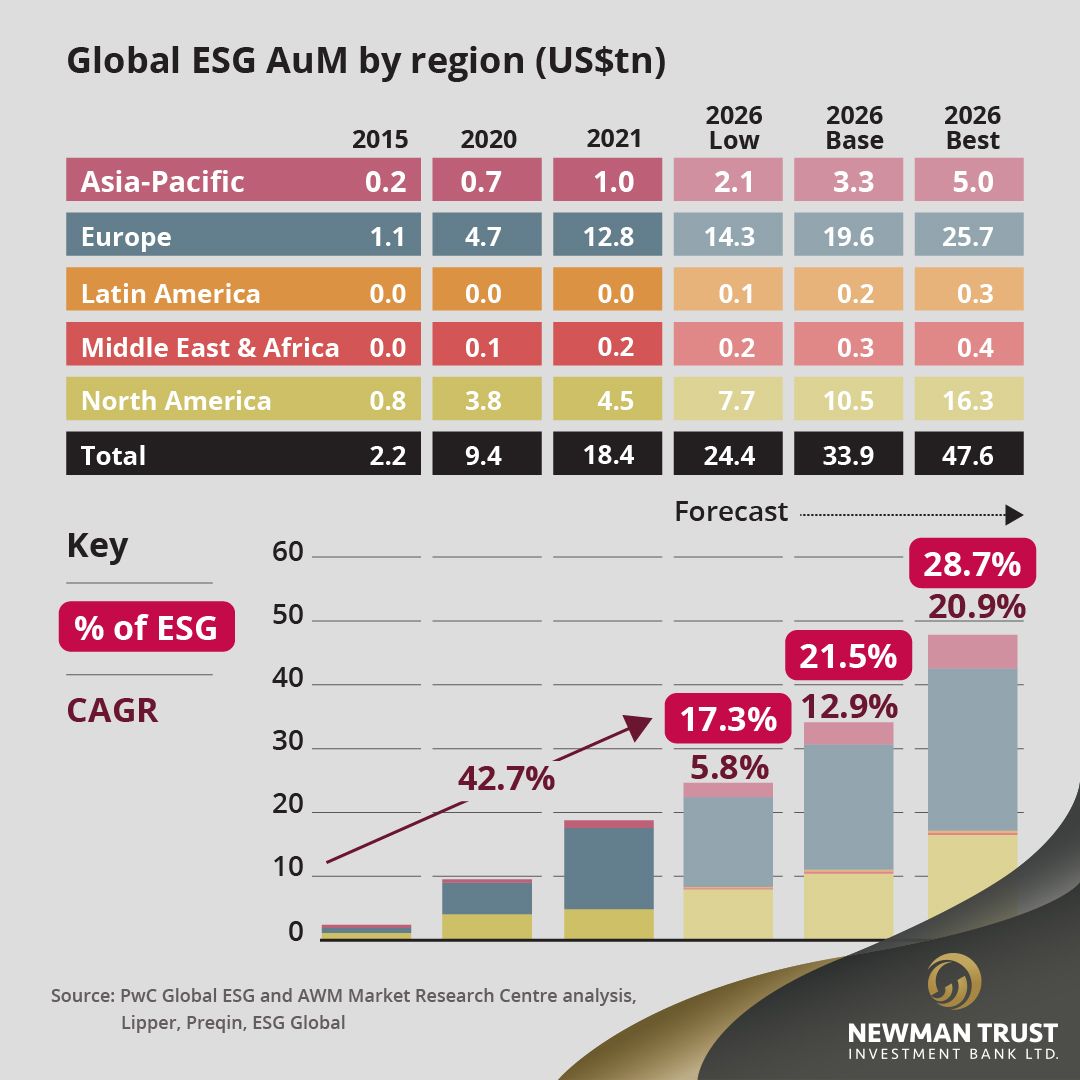

1. ESG Instegration

Integrating ESG factors into investment decisions is no longer optional; it is a necessity. Investors in Southeast Asia are increasingly prioritizing ESG-compliant projects that contribute to sustainability goals while minimizing risk. This trend is particularly prevalent in renewable energy projects, which align with the region’s push for decarbonization. ESG integration also provides investors with a framework for mitigating risks associated with regulatory changes and climate-related impacts. Investors who embrace ESG standards can also benefit from positive brand reputation and enhanced resilience in their portfolios.

2. Long-Term Infrastructure Funds

Given the scale of infrastructure needs, long-term funds dedicated to green projects are gaining popularity. These funds pool capital to finance large-scale developments like solar farms, wind power plants, and electric vehicle infrastructure. Investors seeking exposure to green infrastructure in Southeast Asia should consider participating in these long-term funds, which offer diversification and access to projects that might otherwise be inaccessible.

Furthermore, as governments in the region roll out policies to meet their climate targets, long-term green infrastructure funds are likely to benefit from increasing public support and favorable financing conditions.

3. Public-Private Partnerships (PPP)

Governments across Southeast Asia are increasingly relying on public-private partnerships to finance green infrastructure. These partnerships offer private investors the opportunity to participate in large-scale projects with strong government backing, reducing the risk associated with greenfield developments. PPPs in areas like renewable energy generation and waste management are particularly attractive due to long-term government contracts and stable cash flow potential.

By participating in PPPs, investors can contribute to sustainable development while achieving financial stability through long-term returns.

Capitalizing on Green Growth in Southeast Asia’s Capital Markets

As Southeast Asia continues to pursue sustainable development, the region’s capital markets are becoming increasingly attractive for green investments. Investors can capitalize on the following trends:

Government Incentives: Countries like Malaysia, Singapore, and Vietnam offer incentives, including tax breaks and subsidies, for green infrastructure investments.

Growing Demand for Clean Energy: The rapid shift toward renewable energy sources provides ample opportunities for investors to back projects that align with global decarbonization efforts.

Long-Term Returns: Green infrastructure projects often offer stable, long-term returns, making them attractive for institutional investors seeking steady cash flows.

By adopting sustainable investment strategies and focusing on green infrastructure, investors can not only achieve financial success but also contribute to Southeast Asia’s long-term environmental and social goals.

References:

***Disclaimer: This article is provided for informational purposes only and is not intended as any form of financial, investment, legal, or other professional advice. Before making any investment decisions, it is recommended that you seek advice from financial, investment, and legal professionals to consider your individual financial circumstances and risk tolerance. Neither the author(s) nor the publisher(s) shall be liable for any loss or damage whatsoever arising from or in connection with the content of this article, including but not limited to direct, indirect, incidental, punitive, and consequential damages. Investing in the stock market and other financial markets involves risks, including the loss of principal. Please conduct your own due diligence and consult with a qualified professional before making any investment decisions.